Monday’s economic calendar: macro events that will affect us all economically.

Previously

EUR/USD lost nearly 100 pips on Wednesday and touched a multi-decade low of 1.0161. The pair is staging a modest rebound toward 1.0200 in the early European session. Earlier in the day, the data from Germany showed that Industrial Production expanded by 0.2% in May, missing the market expectation of 0.4%.

GBP/USD is having a difficult time erasing its losses and stays relatively quiet near 1.1950 amid the ongoing political drama in the UK. The Conservative Party’s 1922 Committee will reportedly hold an internal election to appoint a new executive, who can then decide whether to change the rules surrounding the grace period following the no-confidence vote.

Gold slumped to its lowest level since September 2021 at $1,731. Growing recession fears and the broad-based dollar strength weigh on gold’s demand outlook. XAU/USD was last trading in positive territory above $1,740.

USD/JPY struggles to find direction on Thursday and continues to move sideways near 136.00. Although the 10-year US Treasury bond yield gained more than 4% on Wednesday, the pair failed to capitalize with the JPY finding demand as a safe haven.

Bitcoin gained 2% on Wednesday and seems to have settled above $20,000 for the time being. Ethereum consolidates Wednesday’s recovery gains and fluctuates above $1,100.

UPCOMING MACRO

[Monday, 11th July 2022]

- CB Employment Trade Index (US) 119.77 (Current)

An aggregate of eight labor-market indicators that shows underlying trends in employment conditions. Data series: 1973 – present.

The Conference Board Employment Trends Index™ (ETI) declined slightly in May to 119.77, down from 120.60 in April 2022 (an upward revision). “The Employment Trends Index fell slightly in May, signaling slowing, but positive job growth in the months ahead. The labor market may have less room for more growth with overall employment down only 0.5 percent compared to the pre-pandemic level,” said Agron Nicaj, Associate Economist at The Conference Board. “However, leisure and hospitality and in-person services industries have yet to fully recover job losses incurred since the pandemic. Employment growth is still expected in these industries as consumers continue to shift more spending away from goods and towards services.”

Download complete press release

[Tuesday, 12th July 2022]

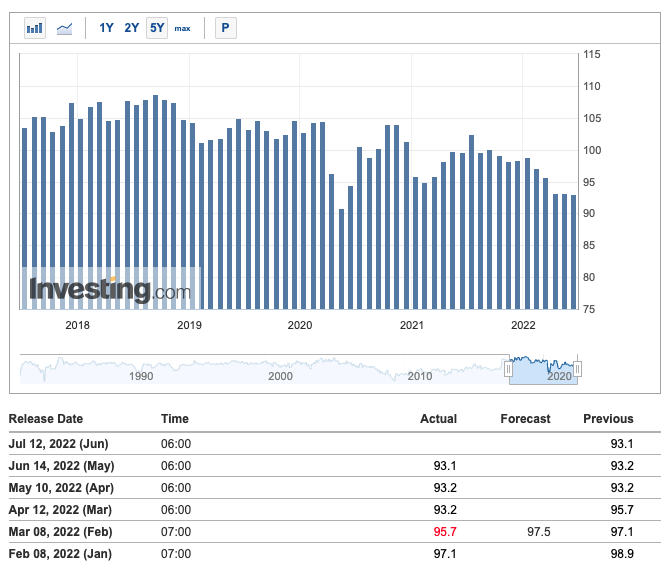

- NFIB Small Business Optimism (US/June) 93.1

The National Federation of Independent Business (NFIB) Small Business Optimism Index is a composite of ten seasonally adjusted components. It provides a indication of the health of small businesses in the U.S., which account of roughly 50% of the nation’s private workforce.

[Wednesday, 13th July 2022]

- Industrial Output (UK/ONS) 1.7% (Forecast) /0.7% (Previous)

Index of Production, UK Statistical bulletins: Movements in the volume of production for the UK production industries: manufacturing, mining and quarrying, energy supply, and water and waste management.

- German CPI 7.9% (Forecast) /7.6% (Previous June)

- Spain CPI 0,8% (Forecast) /1,8% (Previous June)

The Consumer Price Index (CPI) released by the National Institute of Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchase power of Euro is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the Euro, while a low reading is seen as negative (or Bearish).

- US CPI 291.66 (Forecast) / 292.30 (Previous)

The Consumer Price Index released by the US Bureau of Labor Statistcs is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchase power of USD is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as positive (or bullish) for the USD, while a low reading is seen as negative (or Bearish).

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

[Thurday, 14th July 2022]

- US PPI 10.9% (Forecast) / 10.8% (Previous)

The Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

[Friday, 15th July 2022]

- UK Car Registration (June) -20.6%

- German Car Registration (June) -10.2%

Car Registration is the registration of a motor vehicle with a government authority, either compulsory or otherwise. The purpose of motor vehicle registration is to establish a link between a vehicle and an owner or user of the vehicle. This link might be used for taxation or crime detection purposes.

- US Michigan Inflation Expectations (July) ‘-/-5.3%

The preliminary June Michigan survey shortly after May’s CPI was released, showed households now expect inflation to run at a 5.3% annual rate over the next year — up from 4.2% one year ago — and 3.3% annually over the next five years, up from 2.8% in June 2021.